Castle Biosciences (CSTL) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US14843C1053

Castle Biosciences Inc., a pioneering molecular diagnostics company, revolutionizes the way we diagnose and treat various life-altering conditions. By harnessing the power of genetic expression profiling, they provide cutting-edge testing solutions for dermatologic cancers, Barrett's esophagus, uveal melanoma, and mental health conditions.

Their innovative portfolio includes DecisionDx-Melanoma, a game-changing risk stratification test that identifies the likelihood of metastasis in patients with invasive cutaneous melanoma. Additionally, they offer DecisionDx-SCC, a proprietary test that assesses the risk of metastasis in patients with cutaneous squamous cell carcinoma. MyPath Melanoma, another groundbreaking test, helps diagnose melanocytic lesions that are difficult to diagnose.

Their Barrett's esophagus testing solutions are equally impressive. TissueCypher, a spatial omics test, predicts the future development of high-grade dysplasia and/or esophageal cancer in patients with non-dysplastic, indefinite dysplasia, or low-grade dysplasia Barrett's esophagus. This empowers healthcare professionals to take proactive measures, improving patient outcomes.

Furthermore, Castle Biosciences offers DecisionDx-UM, a proprietary test that predicts the risk of metastasis in patients with uveal melanoma. IDgenetix, their pharmacogenomic test, helps guide personalized drug treatment for various mental health conditions, including major depressive disorder, schizophrenia, bipolar disorder, anxiety disorders, social phobia, obsessive-compulsive personality disorder, post-traumatic stress disorder, and attention deficit hyperactivity disorder.

By targeting skin cancer, gastroenterology, and mental health markets, Castle Biosciences is dedicated to improving patient care and outcomes. Founded in 2007, the company is headquartered in Friendswood, Texas, and continues to push the boundaries of molecular diagnostics. Learn more about their innovative solutions at https://castlebiosciences.com.

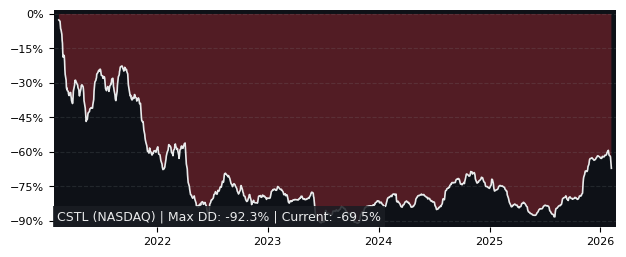

Drawdown (Underwater) Chart

Overall Trend and Yearly Seasonality

CSTL Stock Overview

| Market Cap in USD | 669m |

| Sector | Healthcare |

| Industry | Diagnostics & Research |

| GiC SubIndustry | Biotechnology |

| TER | 0.00% |

| IPO / Inception | 2019-07-25 |

CSTL Stock Ratings

| Growth 5y | 0.02 |

| Fundamental | -34.7 |

| Dividend | - |

| Rel. Performance vs Sector | -0.30 |

| Analysts | 4.89/5 |

| Fair Price Momentum | 25.49 USD |

| Fair Price DCF | - |

CSTL Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

CSTL Growth Ratios

| Growth 12m | -1.50% |

| Growth Correlation 12m | 44% |

| Growth Correlation 3m | 8% |

| CAGR 5y | 2.61% |

| CAGR/Mean DD 5y | 0.06 |

| Sharpe Ratio 12m | -0.07 |

| Alpha vs SP500 12m | -38.89 |

| Beta vs SP500 5y weekly | 1.39 |

| ValueRay RSI | 71.55 |

| Volatility GJR Garch 1y | 47.81% |

| Price / SMA 50 | 13.86% |

| Price / SMA 200 | 23.23% |

| Current Volume | 246.4k |

| Average Volume 20d | 279.2k |

External Links for CSTL Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 18, 2024, the stock is trading at USD 24.24 with a total of 246,374 shares traded.

Over the past week, the price has changed by +0.00%, over one month by +28.66%, over three months by -4.19% and over the past year by +5.90%.

According to ValueRays Forecast Model, CSTL Castle Biosciences will be worth about 28.6 in May 2025. The stock is currently trading at 24.24. This means that the stock has a potential upside of +18.11%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 34.3 | 41.6 |

| Analysts Target Price | 33 | 36.1 |

| ValueRay Target Price | 28.6 | 18.1 |