The Evolution and Current Standing of Alphabet Inc Class C (GOOG)

History of Alphabet Inc

Alphabet Inc., initially known as Google, was founded in September 1998 by Larry Page and Sergey Brin while they were Ph.D. students at Stanford University. In August 2015, Google restructured its business, and Alphabet Inc. was created as the parent holding company of Google and several former Google subsidiaries. The essence of this restructuring was to make the core Google internet services operationally separate from other subsidiary ventures. Alphabet Inc. (GOOG) represents the Class C shares of the company, which have no voting rights, contrasting with the Class A shares (GOOGL) that carry one vote each.

Core and Side Businesses

At the core of Alphabet Inc. is Google Inc., which remains the world's dominant search engine. Google's ecosystem includes other highly popular services such as Android, YouTube, and Google Cloud. These core services contribute the majority of Alphabet's revenues, primarily through advertising.

Beyond its main internet products, Alphabet Inc. operates other businesses through its subsidiaries. These include Access, Calico, CapitalG, GV, Verily, Waymo, and X (formerly Google X). These entities work on a wide range of projects, including access and energy, life sciences, investment capital, self-driving cars, and more. While these side businesses are not the primary revenue sources for Alphabet, they represent significant investments in future technologies and innovations.

Current Market Status

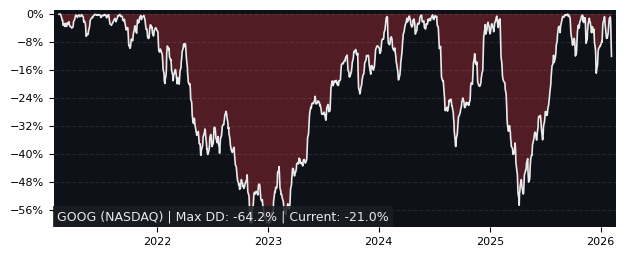

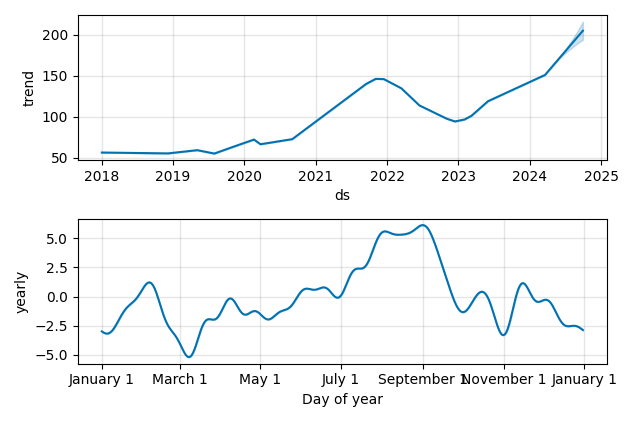

As of the latest fiscal reports, Alphabet Inc. continues to demonstrate strong financial performance, primarily driven by its advertising revenue from Google's core services. The company has also shown resilience and potential for growth in cloud computing and YouTube's subscription services. Despite facing challenges in the form of regulatory concerns and competition, Alphabet's diverse portfolio and ongoing investments in research and development position it well for future growth. The market value of Alphabet Inc. Class C shares has seen fluctuations reflective of the overall tech industry's performance, demonstrating both the opportunities and challenges inherent in the fast-evolving digital economy.