Solowin Holdings Ordinary Share (SWIN)

Exchange: USA Stocks • Country: Hong Kong • Currency: USD • Type: Common Stock • ISIN: -s

Solowin Holdings is a dynamic investment holding company that offers a comprehensive range of financial services in Hong Kong. The company's expertise spans securities brokerage, corporate finance, investment advisory, and asset management, catering to a diverse client base.

At the heart of Solowin Holdings' operations is Solomon Pro, a cutting-edge trading platform that enables investors to seamlessly trade listed securities and their derivative products across prominent exchanges, including the Hong Kong Stock Exchange, New York Stock Exchange, Nasdaq, Shanghai Stock Exchange, and Shenzhen Stock Exchange.

The company's extensive service portfolio includes Hong Kong securities trading, initial public offering subscription and placement, bond trading, fund subscription, equity custodian and agent services, investment immigrant account management, enterprise employee shareholding exercise, professional investment research, and instant quotation services. This comprehensive suite of services empowers clients to make informed investment decisions and navigate the complexities of the financial markets.

Solowin Holdings' investment advisory services are tailored to meet the unique financial needs and risk appetites of its clients. The company's experienced professionals work closely with clients to develop personalized investment strategies, ensuring that their financial goals are aligned with their risk tolerance. Additionally, Solowin Holdings issues and manages a diverse range of fund products, providing clients with access to a broad spectrum of investment opportunities.

The company's asset management services are designed to meet the specific needs of financial institutions and private institutions. Solowin Holdings' team of experts provides tailored financial services to individual investors, investment banking services, and financial and independent financial advisory services for both listed and unlisted companies. Furthermore, the company offers offshore private fund investment services, expanding its clients' investment horizons.

Established in 2021, Solowin Holdings is headquartered in Tsim Sha Tsui, Hong Kong, and is committed to delivering exceptional financial services to its clients. For more information, please visit their website at https://www.solomonwin.com.hk.

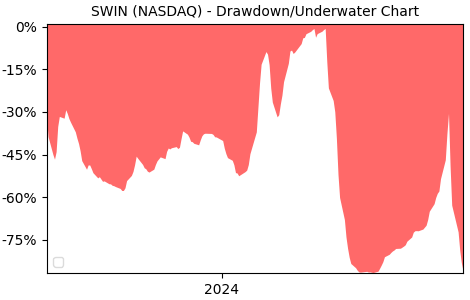

Drawdown (Underwater) Chart

SWIN Stock Overview

| Market Cap in USD | 30m |

| Sector | Financial Services |

| Industry | Capital Markets |

| GiC SubIndustry | Asset Management & Custody Banks |

| TER | 0.00% |

| IPO / Inception | 2023-09-07 |

SWIN Stock Ratings

| Growth 5y | 6.41 |

| Fundamental | 19.1 |

| Dividend | - |

| Rel. Performance vs Sector | 15.47 |

| Analysts | - |

| Fair Price Momentum | 36.34 USD |

| Fair Price DCF | - |

SWIN Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

SWIN Growth Ratios

| Growth 12m | 325.00% |

| Growth Correlation 12m | 62% |

| Growth Correlation 3m | 32% |

| CAGR 5y | 325.00% |

| CAGR/Mean DD 5y | 6.92 |

| Sharpe Ratio 12m | 1.56 |

| Alpha vs SP500 12m | 239.29 |

| Beta vs SP500 5y weekly | 3.48 |

| ValueRay RSI | 95.29 |

| Volatility GJR Garch 1y | 96.26% |

| Price / SMA 50 | 107.88% |

| Price / SMA 200 | 286.25% |

| Current Volume | 1524.4k |

| Average Volume 20d | 331.2k |

External Links for SWIN Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 18, 2024, the stock is trading at USD 25.84 with a total of 1,524,358 shares traded.

Over the past week, the price has changed by +35.01%, over one month by +150.87%, over three months by +295.11% and over the past year by +325.00%.

According to ValueRays Forecast Model, SWIN Solowin Holdings Ordinary Share will be worth about 42.1 in May 2025. The stock is currently trading at 25.84. This means that the stock has a potential upside of +62.93%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 42.1 | 62.9 |