Allete (ALE) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US0185223007

ALLETE, Inc. is a leading energy company that operates through three main segments: Regulated Operations, ALLETE Clean Energy, and Corporate and Other. The company generates electricity from a diverse range of sources, including coal-fired, biomass co-fired, natural gas, hydroelectric, wind, and solar power. This diversified energy mix enables ALLETE to provide reliable and sustainable energy solutions to its customers.

In terms of its regulated utility services, ALLETE provides electric, natural gas, and water services to thousands of customers in northwestern Wisconsin and northeastern Minnesota. The company's regulated utility services cater to a wide range of customers, including residential, commercial, and industrial clients. In addition, ALLETE owns and maintains an extensive network of electric transmission assets across Wisconsin, Michigan, Minnesota, and Illinois, ensuring the efficient transmission of electricity to its customers.

ALLETE is also a leading player in the clean and renewable energy space, with a focus on developing, acquiring, and operating wind energy projects. The company owns and operates approximately 1,200 megawatts of wind energy generation facilities, making it a significant contributor to the growth of renewable energy in the region. Furthermore, ALLETE is involved in coal mining operations in North Dakota, providing a reliable source of fuel for its power generation activities.

In addition to its energy generation and transmission activities, ALLETE also has a significant presence in the real estate sector, with investments in Florida-based real estate projects. The company's diversified portfolio of businesses enables it to mitigate risks and capitalize on growth opportunities across different sectors.

With a rich history dating back to 1906, ALLETE has undergone significant transformations over the years, including a name change from Minnesota Power, Inc. to ALLETE, Inc. in 2001. Today, the company is headquartered in Duluth, Minnesota, and continues to play a vital role in providing energy solutions to its customers across the region.

For more information about ALLETE, Inc., please visit its website at https://www.allete.com.

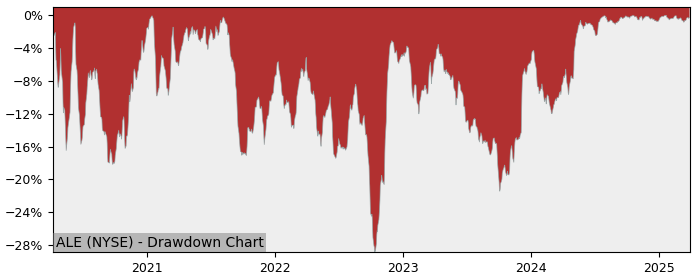

Drawdown (Underwater) Chart

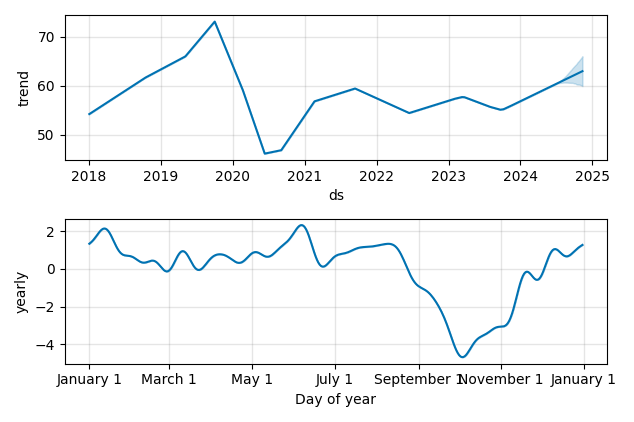

Overall Trend and Yearly Seasonality

ALE Stock Overview

| Market Cap in USD | 3,645m |

| Sector | Utilities |

| Industry | Utilities - Diversified |

| GiC SubIndustry | Electric Utilities |

| TER | 0.00% |

| IPO / Inception | 1973-05-03 |

ALE Stock Ratings

| Growth 5y | -0.04 |

| Fundamental | 39.0 |

| Dividend | 7.01 |

| Rel. Performance vs Sector | -0.42 |

| Analysts | 3.29/5 |

| Fair Price Momentum | 57.88 USD |

| Fair Price DCF | 138.41 USD |

ALE Dividends

| Yield 12m | 4.40% |

| Yield on Cost 5y | 4.15% |

| Dividends CAGR 5y | 2.89% |

| Payout Consistency | 96.3% |

ALE Growth Ratios

| Growth 12m | 6.67% |

| Growth Correlation 12m | 28% |

| Growth Correlation 3m | 71% |

| CAGR 5y | -1.17% |

| CAGR/Mean DD 5y | -0.06 |

| Sharpe Ratio 12m | 0.06 |

| Alpha vs SP500 12m | -17.60 |

| Beta vs SP500 5y weekly | 0.83 |

| ValueRay RSI | 79.70 |

| Volatility GJR Garch 1y | 17.82% |

| Price / SMA 50 | 6.03% |

| Price / SMA 200 | 11.68% |

| Current Volume | 678.3k |

| Average Volume 20d | 714.5k |

External Links for ALE Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 18, 2024, the stock is trading at USD 62.80 with a total of 678,309 shares traded.

Over the past week, the price has changed by +0.48%, over one month by +9.74%, over three months by +8.37% and over the past year by +7.05%.

According to ValueRays Forecast Model, ALE Allete will be worth about 63 in May 2025. The stock is currently trading at 62.80. This means that the stock has a potential upside of +0.29%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 62 | -1.32 |

| Analysts Target Price | 59.7 | -4.98 |

| ValueRay Target Price | 63 | 0.29 |