Bright Horizons Family Solutions (BFAM)

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US1091941005

Bright Horizons Family Solutions Inc. is a leading provider of early education and childcare services, offering a range of solutions to support working families and employers. With operations in the United States, Puerto Rico, the United Kingdom, the Netherlands, Australia, and India, the company provides a comprehensive suite of services designed to support the needs of modern families.

The company's Full Service Center-Based Child Care segment provides high-quality early education and childcare services, including traditional center-based child care, preschool, and elementary education programs. These programs are designed to foster a love of learning, promote social and emotional development, and prepare children for future success.

In addition to its center-based services, Bright Horizons also offers a range of back-up care solutions, including center-based back-up child care, in-home child and adult/elder dependent care, school-age camps, virtual tutoring, and self-sourced reimbursed care services. These services provide families with the support they need to balance work and family responsibilities, while also ensuring the care and well-being of their loved ones.

Bright Horizons' Educational Advisory and Other Services segment offers a range of educational consulting services, including tuition assistance and student loan repayment program administration, workforce education, and college admissions and college financial advisory services. These services are designed to support employees and their families as they navigate the complexities of education and career development.

Founded in 1986 and headquartered in Newton, Massachusetts, Bright Horizons Family Solutions Inc. has a long history of providing innovative solutions to support working families and employers. With a commitment to quality, safety, and customer satisfaction, the company has established itself as a leader in the early education and childcare industry.

Drawdown (Underwater) Chart

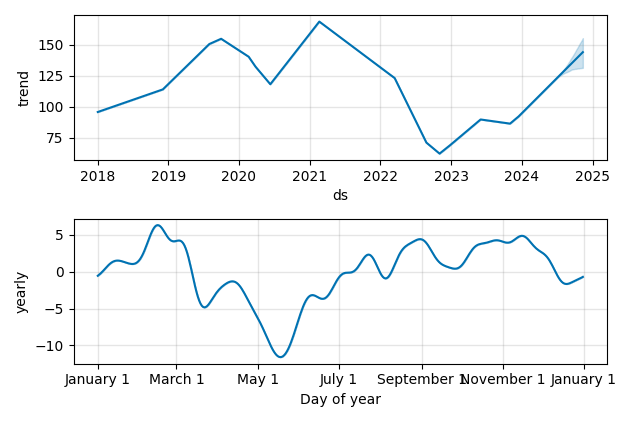

Overall Trend and Yearly Seasonality

BFAM Stock Overview

| Market Cap in USD | 6,679m |

| Sector | Consumer Cyclical |

| Industry | Personal Services |

| GiC SubIndustry | Education Services |

| TER | 0.00% |

| IPO / Inception | 1997-08-12 |

BFAM Stock Ratings

| Growth 5y | -1.25 |

| Fundamental | 8.73 |

| Dividend | - |

| Rel. Performance vs Sector | 0.69 |

| Analysts | 3.30/5 |

| Fair Price Momentum | 117.25 USD |

| Fair Price DCF | 101.27 USD |

BFAM Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

BFAM Growth Ratios

| Growth 12m | 25.36% |

| Growth Correlation 12m | 46% |

| Growth Correlation 3m | -24% |

| CAGR 5y | -3.82% |

| CAGR/Mean DD 5y | -0.12 |

| Sharpe Ratio 12m | 0.67 |

| Alpha vs SP500 12m | -7.89 |

| Beta vs SP500 5y weekly | 1.21 |

| ValueRay RSI | 31.29 |

| Volatility GJR Garch 1y | 29.24% |

| Price / SMA 50 | -1.77% |

| Price / SMA 200 | 12.61% |

| Current Volume | 462k |

| Average Volume 20d | 349.7k |

External Links for BFAM Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 18, 2024, the stock is trading at USD 109.06 with a total of 461,995 shares traded.

Over the past week, the price has changed by -3.23%, over one month by +5.43%, over three months by -1.63% and over the past year by +25.37%.

According to ValueRays Forecast Model, BFAM Bright Horizons Family Solutions will be worth about 130.3 in May 2025. The stock is currently trading at 109.06. This means that the stock has a potential upside of +19.48%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 113.6 | 4.13 |

| Analysts Target Price | 90.7 | -16.8 |

| ValueRay Target Price | 130.3 | 19.5 |