Hilton Worldwide Holdings (HLT) - Stock & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US43300A2033

Hilton Worldwide Holdings Inc. is a well-known hospitality company that specializes in managing, franchising, owning, and leasing hotels and resorts. They have two distinct segments, namely Management and Franchise, and Ownership.

The company is dedicated to hotel management and licensing their renowned brands across a wide range of hotel categories. These include luxury hotels such as Waldorf Astoria Hotels & Resorts, LXR Hotels & Resorts, and Conrad Hotels & Resorts. They also operate lifestyle hotels like Canopy by Hilton, Curio Collection by Hilton, Tapestry Collection by Hilton, Tempo by Hilton, and Motto by Hilton.

In addition, Hilton runs full-service hotels under brands such as Signia by Hilton, Hilton Hotels & Resorts, and DoubleTree by Hilton. They also offer select-service hotels under Hilton Garden Inn, Hampton by Hilton, and Tru by Hilton, all-suite hotels under Embassy Suites by Hilton, Homewood Suites by Hilton, and Home2 Suites by Hilton, as well as economy hotels under the Spark by Hilton brand, alongside Hilton Grand Vacations.

Established in 1919, Hilton Worldwide Holdings Inc. is headquartered in McLean, Virginia, and their operations span across various regions including North America, South America, Central America, the Caribbean, Europe, the Middle East, Africa, and the Asia Pacific.

For more information, visit their official website: https://www.hilton.com.

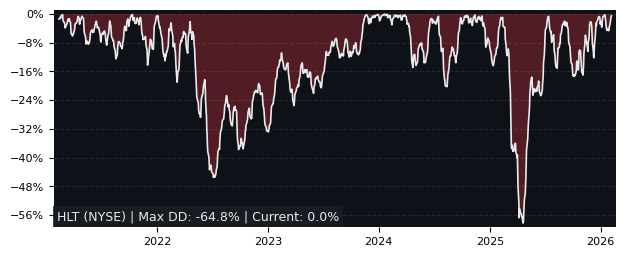

Drawdown (Underwater) Chart

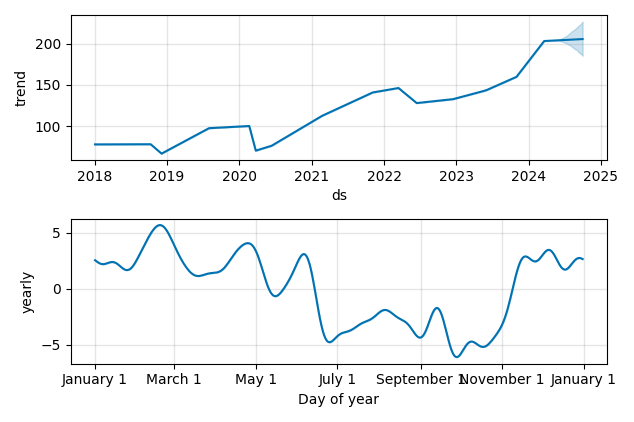

Overall Trend and Yearly Seasonality

HLT Stock Overview

| Market Cap in USD | 49,527m |

| Sector | Consumer Cyclical |

| Industry | Lodging |

| GiC SubIndustry | Hotels, Resorts & Cruise Lines |

| TER | 0.00% |

| IPO / Inception | 2013-12-12 |

HLT Stock Ratings

| Growth 5y | 7.82 |

| Fundamental | 29.8 |

| Dividend | 3.47 |

| Rel. Performance vs Sector | 1.15 |

| Analysts | 3.65/5 |

| Fair Price Momentum | 205.07 USD |

| Fair Price DCF | 189.04 USD |

HLT Dividends

| Yield 12m | 0.30% |

| Yield on Cost 5y | 0.66% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 71.9% |

HLT Growth Ratios

| Growth 12m | 37.11% |

| Growth Correlation 12m | 80% |

| Growth Correlation 3m | 24% |

| CAGR 5y | 16.72% |

| Sharpe Ratio 12m | 1.62 |

| Alpha vs SP500 12m | 7.16 |

| Beta vs SP500 5y weekly | 1.21 |

| ValueRay RSI | 9.44 |

| Volatility GJR Garch 1y | 25.51% |

| Price / SMA 50 | -3.85% |

| Price / SMA 200 | 12.65% |

| Current Volume | 1725.3k |

| Average Volume 20d | 1641.5k |

External Links for HLT Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 05, 2024, the stock is trading at USD 197.54 with a total of 1,725,322 shares traded.

Over the past week, the price has changed by -2.27%, over one month by -6.90%, over three months by +1.37% and over the past year by +36.05%.

According to ValueRays Forecast Model, HLT Hilton Worldwide Holdings will be worth about 227.5 in May 2025. The stock is currently trading at 197.54. This means that the stock has a potential upside of +15.16%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 214.6 | 8.65 |

| Analysts Target Price | 164.6 | -16.7 |

| ValueRay Target Price | 227.5 | 15.2 |