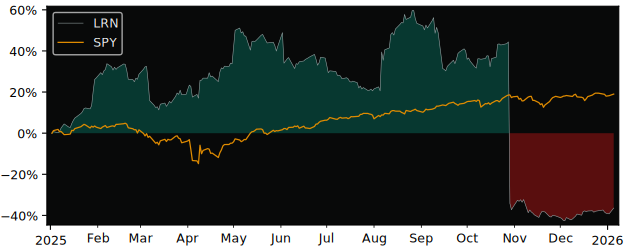

Performance of LRN Stride | 68.6% in 12m

Compare LRN with Indices, Sectors and Commodities ✔ like Oil, Gas, Gold, Yields and Bonds. Who outperforms?

Compare Stride with its related Sector/Index XLY

Performance Duell LRN vs XLY

| TimeFrame | LRN | XLY |

|---|---|---|

| 1 Day | -0.45% | 0.51% |

| 1 Week | -1.42% | 0.34% |

| 1 Month | 22.0% | 3.70% |

| 3 Months | 23.0% | 0.04% |

| 6 Months | 22.9% | 7.34% |

| 12 Months | 68.6% | 19.67% |

| YTD | 16.1% | 1.09% |

| Rel. Perf. 1m | 1.68 | |

| Rel. Perf. 3m | 1.38 | |

| Rel. Perf. 6m | 1.37 | |

| Rel. Perf. 12m | 3.48 |

Is Stride a good stock to buy?

Yes, based on ValueRay Fundamental Analyses, Stride (NYSE:LRN) is currently (May 2024)

a good stock to buy. It has a ValueRay Fundamental Rating of 74.21 and therefor a positive outlook according to the companies health.

Based on ValueRays Analyses, Dividends and Discounted-Cash-Flow, the Fair Value of LRN as of May 2024 is 76.51. This means that LRN is currently overvalued and has a potential downside of 8.97% (Sold with Premium).

Based on ValueRays Analyses, Dividends and Discounted-Cash-Flow, the Fair Value of LRN as of May 2024 is 76.51. This means that LRN is currently overvalued and has a potential downside of 8.97% (Sold with Premium).

Is LRN a buy, sell or hold?

- Strong Buy: 2

- Buy: 2

- Hold: 1

- Sell: 0

- Strong Sell: 0

Values above 0%: LRN is performing better - Values below 0%: LRN is underperforming

Compare LRN with Broad Market Indices

| Symbol | 1w | 1m | 6m | 12m | |

|---|---|---|---|---|---|

| US S&P 500 | SPY | -3.07% | 16.19% | 4.58% | 39.26% |

| US NASDAQ 100 | QQQ | -3.61% | 15.87% | 5.40% | 31.26% |

| US Dow Jones Industrial 30 | DIA | -2.78% | 15.79% | 7.40% | 46.59% |

| German DAX 40 | DBXD | -1.02% | 16.99% | 5.88% | 51.84% |

| UK FTSE 100 | ISFU | -2.92% | 12.16% | 6.01% | 53.24% |

| Shanghai Shenzhen CSI 300 | CSI 300 | -2.53% | 17.44% | 19.54% | 76.28% |

| Hongkong Hang Seng | HSI | -5.15% | -1.32% | 17.83% | 73.97% |

| Japan Nikkei 225 | EXX7 | -1.79% | 22.46% | 11.38% | 56.80% |

| India NIFTY 50 | INDA | -4.53% | 18.04% | 5.29% | 39.89% |

| Brasil Bovespa | EWZ | -1.86% | 16.72% | 24.70% | 56.28% |

LRN Stride vs. Sectors

| Symbol | 1w | 1m | 6m | 12m | |

|---|---|---|---|---|---|

| Communication Services | XLC | -2.42% | 18.65% | 4.36% | 31.13% |

| Consumer Discretionary | XLY | -1.76% | 18.26% | 15.53% | 48.94% |

| Consumer Staples | XLP | -2.18% | 15.38% | 8.63% | 63.03% |

| Energy | XLE | -2.62% | 21.08% | 8.75% | 43.39% |

| Financial | XLF | -3.00% | 14.91% | 0.45% | 35.54% |

| Health Care | XLV | -3.31% | 16.28% | 7.86% | 55.11% |

| Industrial | XLI | -1.14% | 18.48% | 3.18% | 40.28% |

| Materials | XLB | -1.76% | 18.42% | 6.85% | 47.99% |

| Real Estate | XLRE | -3.93% | 13.48% | 13.23% | 58.63% |

| Technology | XLK | -4.48% | 15.44% | 6.55% | 30.30% |

| Utilities | XLU | -2.92% | 9.07% | 4.67% | 55.93% |

| Aerospace & Defense | XAR | -2.19% | 13.50% | 7.33% | 44.46% |

| Biotech | XBI | -4.87% | 14.25% | -2.64% | 62.24% |

| Homebuilder | XHB | -1.10% | 15.62% | -7.64% | 17.76% |

| Retail | XRT | -3.50% | 14.50% | 2.03% | 43.42% |

Does Stride outperform its market, is LRN a Sector Leader?

Yes, over the last 12 months Stride (LRN) made 68.61%, while its related Sector, the Consumer Discretionary Sector SPDR.. (XLY) made 19.67%.

Over the last 3 months LRN made 23.00%, while XLY made 0.04%.

Yes, over the last 12 months Stride (LRN) made 68.61%, while its related Sector, the Consumer Discretionary Sector SPDR.. (XLY) made 19.67%.

Over the last 3 months LRN made 23.00%, while XLY made 0.04%.

| Period | LRN | XLY | S&P 500 |

|---|---|---|---|

| 1 Month | 21.96% | 3.70% | 5.77% |

| 3 Months | 23.00% | 0.04% | 6.32% |

| 12 Months | 68.61% | 19.67% | 29.35% |