Select Medical Holdings (SEM) - Stock & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US81619Q1058

Select Medical Holdings Corporation is a leading healthcare company that operates a diverse range of medical facilities across the United States. Through its subsidiaries, the company provides specialized healthcare services to patients with critical illnesses, injuries, and disabilities.

The company's Critical Illness Recovery Hospital segment focuses on providing care to patients with life-threatening conditions, such as heart failure, infectious diseases, and respiratory failure. These hospitals offer prolonged recovery services, including treatment for renal disease, neurological events, and trauma.

In addition to critical illness care, Select Medical also operates Rehabilitation Hospitals that offer comprehensive therapy and rehabilitation programs. These programs cater to patients with brain and spinal cord injuries, strokes, amputations, and other neurological disorders. The company's rehabilitation services also extend to pediatric patients with congenital or acquired disabilities, as well as those with orthopedic conditions and cancer.

Select Medical's Outpatient Rehabilitation segment operates a network of clinics that provide physical, occupational, and speech rehabilitation programs. These clinics offer specialized services, including functional programs for work-related injuries, hand therapy, post-concussion rehabilitation, pediatric and cancer rehabilitation, and athletic training services.

The company's Concentra segment focuses on occupational health, operating occupational health centers, telemedicine platforms, onsite clinics, and contract services at employer worksites. Concentra provides a range of services, including occupational health, consumer health, physical therapy, and preventive care.

Founded in 1996, Select Medical Holdings Corporation is headquartered in Mechanicsburg, Pennsylvania, and has established itself as a leading provider of specialized healthcare services. With a strong online presence, the company's website (https://www.selectmedical.com) provides easy access to information on its services, facilities, and programs.

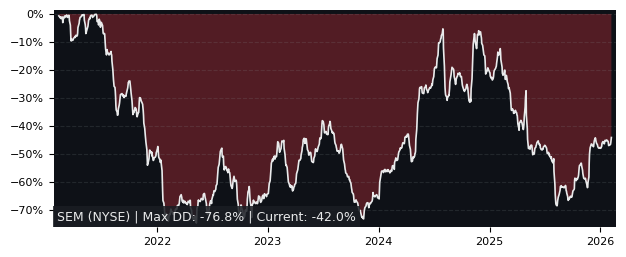

Drawdown (Underwater) Chart

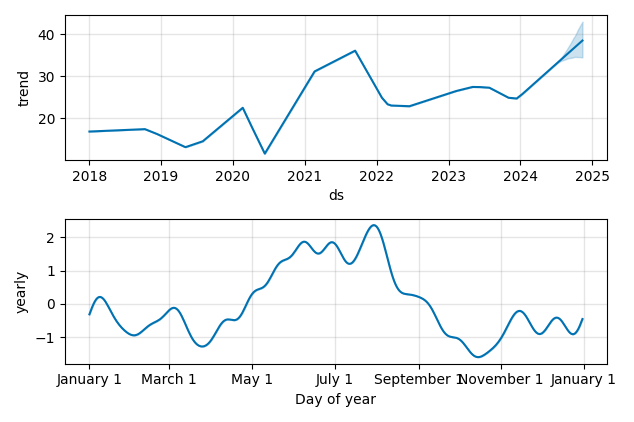

Overall Trend and Yearly Seasonality

SEM Stock Overview

| Market Cap in USD | 4,431m |

| Sector | Healthcare |

| Industry | Medical Care Facilities |

| GiC SubIndustry | Health Care Facilities |

| TER | 0.00% |

| IPO / Inception | 2009-09-25 |

SEM Stock Ratings

| Growth 5y | 4.36 |

| Fundamental | 44.2 |

| Dividend | 2.66 |

| Rel. Performance vs Sector | 0.83 |

| Analysts | 4.40/5 |

| Fair Price Momentum | 33.08 USD |

| Fair Price DCF | 50.82 USD |

SEM Dividends

| Yield 12m | 1.47% |

| Yield on Cost 5y | 3.55% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 38.5% |

SEM Growth Ratios

| Growth 12m | 21.33% |

| Growth Correlation 12m | 1% |

| Growth Correlation 3m | 41% |

| CAGR 5y | 19.15% |

| CAGR/Mean DD 5y | 0.74 |

| Sharpe Ratio 12m | 0.51 |

| Alpha vs SP500 12m | -15.74 |

| Beta vs SP500 5y weekly | 1.38 |

| ValueRay RSI | 90.54 |

| Volatility GJR Garch 1y | 27.80% |

| Price / SMA 50 | 15.32% |

| Price / SMA 200 | 28.99% |

| Current Volume | 444.3k |

| Average Volume 20d | 611.5k |

External Links for SEM Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 18, 2024, the stock is trading at USD 33.95 with a total of 444,268 shares traded.

Over the past week, the price has changed by +1.44%, over one month by +27.96%, over three months by +26.09% and over the past year by +23.23%.

According to ValueRays Forecast Model, SEM Select Medical Holdings will be worth about 35.9 in May 2025. The stock is currently trading at 33.95. This means that the stock has a potential upside of +5.74%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 38 | 11.9 |

| Analysts Target Price | 37.5 | 10.5 |

| ValueRay Target Price | 35.9 | 5.74 |