Advanced Drainage Systems (WMS) - Stock & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US00790R1041

Advanced Drainage Systems, Inc. (NYSE: WMS) is a company that specializes in designing, manufacturing, and selling thermoplastic corrugated pipes and water management products. Their products are used in construction and agriculture industries across the United States, Canada, Mexico, and globally. They have different segments within the company such as Pipe, International, Infiltrator, and Allied Products & Other.

Their product range includes single, double, and triple wall corrugated polypropylene and polyethylene pipes, plastic leachfield chambers and systems, EZflow synthetic aggregate bundles, mechanical aeration wastewater solutions, septic tanks, combined treatment and dispersal systems, as well as storm retention/detention and septic chambers, drainage structures, fittings, and water quality filters. They also offer construction fabrics, geosynthetic products, drainage grates, and other related items.

Advanced Drainage Systems, Inc. also provides Presby environmental enviro-septic and advanced enviro-septic systems, PVC hubs, rubber sleeves, stainless-steel bands, and more. Their products cater to various applications like non-residential, residential, agriculture, and infrastructure needs. With around 40 distribution centers, the company ensures their products reach customers effectively.

Established in 1966 and headquartered in Hilliard, Ohio, Advanced Drainage Systems, Inc. has been a key player in the industry for several decades. For more information, you can visit their website at https://www.adspipe.com.

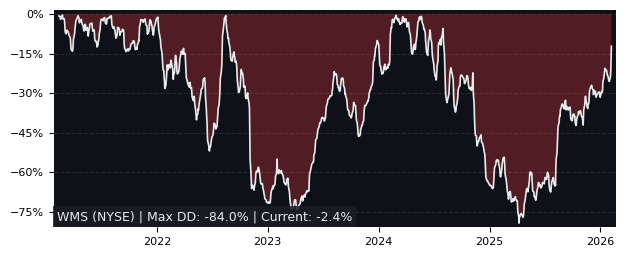

Drawdown (Underwater) Chart

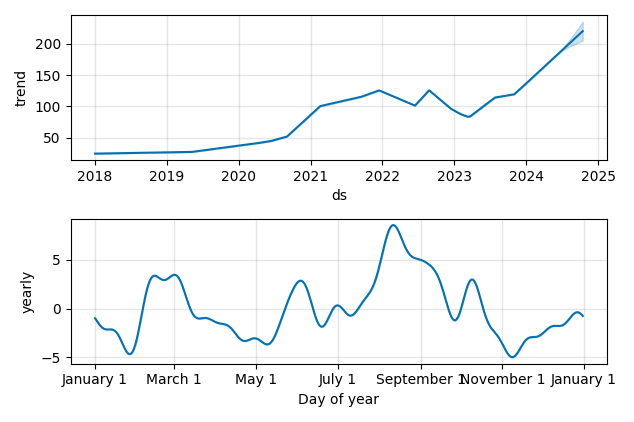

Overall Trend and Yearly Seasonality

WMS Stock Overview

| Market Cap in USD | 12,444m |

| Sector | Industrials |

| Industry | Building Products & Equipment |

| GiC SubIndustry | Building Products |

| TER | 0.00% |

| IPO / Inception | 2014-07-25 |

WMS Stock Ratings

| Growth 5y | 8.31 |

| Fundamental | 77.7 |

| Dividend | 2.27 |

| Rel. Performance vs Sector | 5.23 |

| Analysts | 4.50/5 |

| Fair Price Momentum | 197.90 USD |

| Fair Price DCF | 196.20 USD |

WMS Dividends

| Yield 12m | 0.34% |

| Yield on Cost 5y | 2.10% |

| Dividends CAGR 5y | -16.71% |

| Payout Consistency | 93.2% |

WMS Growth Ratios

| Growth 12m | 90.12% |

| Growth Correlation 12m | 65% |

| Growth Correlation 3m | 7% |

| CAGR 5y | 43.91% |

| Sharpe Ratio 12m | 2.51 |

| Alpha vs SP500 12m | 57.39 |

| Beta vs SP500 5y weekly | 1.34 |

| ValueRay RSI | 49.18 |

| Volatility GJR Garch 1y | 34.56% |

| Price / SMA 50 | 0.37% |

| Price / SMA 200 | 21.65% |

| Current Volume | 342.9k |

| Average Volume 20d | 382.1k |

External Links for WMS Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 05, 2024, the stock is trading at USD 164.89 with a total of 342,877 shares traded.

Over the past week, the price has changed by +1.35%, over one month by -1.58%, over three months by +22.20% and over the past year by +93.14%.

According to ValueRays Forecast Model, WMS Advanced Drainage Systems will be worth about 221.3 in May 2025. The stock is currently trading at 164.89. This means that the stock has a potential upside of +34.23%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 178 | 7.95 |

| Analysts Target Price | 151 | -8.42 |

| ValueRay Target Price | 221.3 | 34.2 |