IGM Financial (IGM) - Stock Price & Dividends

Exchange: Toronto Exchange • Country: Canada • Currency: CAD • Type: Common Stock • ISIN: CA4495861060

IGM Financial Inc. is a leading wealth and asset management company in Canada, dedicated to helping individuals and institutions achieve their financial goals.

The company's Wealth Management segment offers a range of investment solutions, including financial planning and related services, mutual fund management, and discretionary portfolio management services. This allows clients to make informed investment decisions and achieve their financial objectives.

The Asset Management segment provides investment management services to a diverse range of investment funds, which are distributed through third-party dealers and financial advisors. This enables investors to access a broad spectrum of investment opportunities and manage their wealth effectively.

In addition to its wealth and asset management services, IGM Financial Inc. also offers a suite of insurance and banking products and services, providing clients with a comprehensive range of financial solutions.

Founded in 1978 and headquartered in Winnipeg, Canada, IGM Financial Inc. is a subsidiary of Power Financial Corporation, a leading Canadian financial services company. With a strong legacy of over 40 years, IGM Financial Inc. has established itself as a trusted partner for individuals, families, and institutions seeking to manage their wealth and achieve long-term financial success.

For more information, please visit https://www.igmfinancial.com.

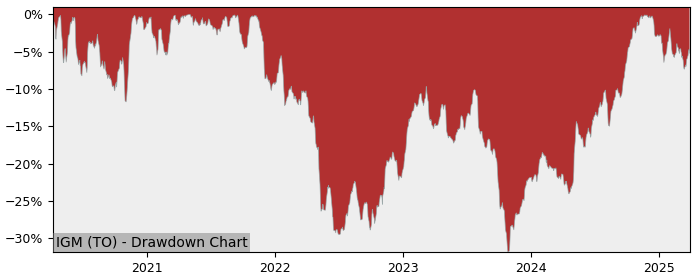

Drawdown (Underwater) Chart

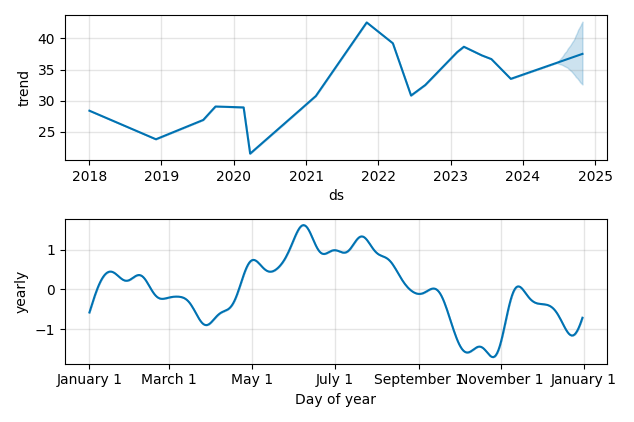

Overall Trend and Yearly Seasonality

IGM Stock Overview

| Market Cap in USD | 6,488m |

| Sector | Financial Services |

| Industry | Asset Management |

| GiC SubIndustry | Asset Management & Custody Banks |

| TER | 0.00% |

| IPO / Inception |

IGM Stock Ratings

| Growth 5y | 2.24 |

| Fundamental | 9.18 |

| Dividend | 7.03 |

| Rel. Performance vs Sector | -2.91 |

| Analysts | - |

| Fair Price Momentum | 34.72 CAD |

| Fair Price DCF | 82.08 CAD |

IGM Dividends

| Yield 12m | 6.09% |

| Yield on Cost 5y | 8.25% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 95.9% |

IGM Growth Ratios

| Growth 12m | 0.67% |

| Growth Correlation 12m | -25% |

| Growth Correlation 3m | -4% |

| CAGR 5y | 6.27% |

| CAGR/Mean DD 5y | 0.47 |

| Sharpe Ratio 12m | -0.23 |

| Alpha vs SP500 12m | -24.88 |

| Beta vs SP500 5y weekly | 0.88 |

| ValueRay RSI | 68.45 |

| Volatility GJR Garch 1y | 20.20% |

| Price / SMA 50 | 5.57% |

| Price / SMA 200 | 7.23% |

| Current Volume | 132.8k |

| Average Volume 20d | 218.1k |

External Links for IGM Stock

As of May 18, 2024, the stock is trading at CAD 36.95 with a total of 132,842 shares traded.

Over the past week, the price has changed by -1.81%, over one month by +10.73%, over three months by +7.00% and over the past year by +0.29%.

According to ValueRays Forecast Model, IGM IGM Financial will be worth about 37.7 in May 2025. The stock is currently trading at 36.95. This means that the stock has a potential upside of +1.95%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 43.1 | 16.8 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 37.7 | 1.95 |