NAPCO Security Technologies (NSSC) - Stock & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US6304021057

Napco Security Technologies, Inc. is a leading developer, manufacturer, and supplier of electronic security products that cater to a wide range of industries, including commercial, residential, institutional, industrial, and governmental sectors in the United States and internationally.

The company's comprehensive product portfolio includes access control systems, door-locking products, intrusion and fire alarm systems, and video surveillance systems. Its access control systems feature advanced identification readers, control panels, PC-based computers, and electronically activated door-locking devices that ensure secure and convenient access control.

The door locking devices offered by Napco Security Technologies, Inc. are highly advanced, featuring microprocessor-based electronic door locks with push-button, card reader, and biometric operation, as well as door alarms, mechanical door locks, and simple deadbolt locks.

The company's alarm systems are designed to provide reliable and efficient security solutions, comprising automatic communicators, cellular communication devices, control panels, combination control panels/digital communicators, digital keypad systems, fire alarm control panels, and area detectors.

Its video surveillance systems consist of high-quality video cameras, control panels, video monitors, or PCs that provide crystal-clear video feeds and enable real-time monitoring.

In addition to its own products, Napco Security Technologies, Inc. also resells various identification readers, video cameras, PC-based computers, and peripheral equipment from other manufacturers, further expanding its offerings to customers.

The company also specializes in school security products, providing tailored solutions to ensure the safety and security of educational institutions.

Napco Security Technologies, Inc. markets and sells its products to a network of independent distributors, dealers, and installers of security equipment, providing them with reliable and efficient security solutions.

With a rich history dating back to 1969, Napco Security Technologies, Inc. is headquartered in Amityville, New York, and continues to innovate and expand its product offerings to meet the evolving security needs of its customers.

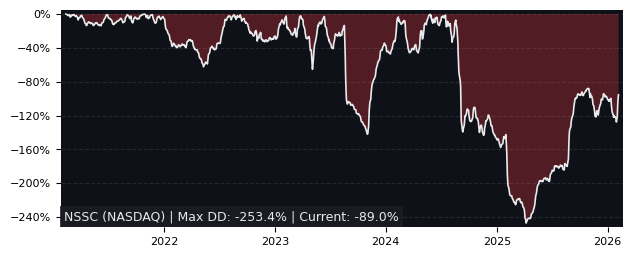

Drawdown (Underwater) Chart

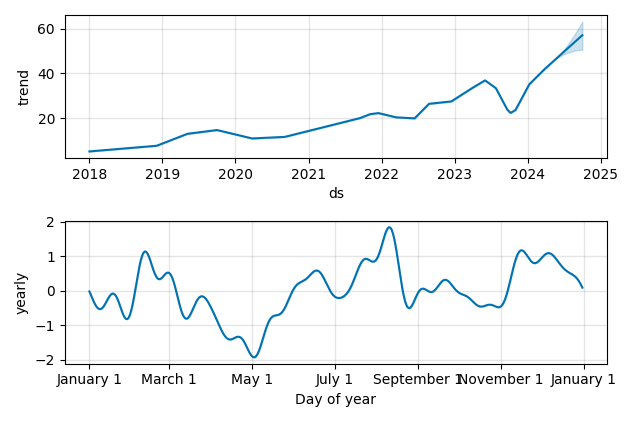

Overall Trend and Yearly Seasonality

NSSC Stock Overview

| Market Cap in USD | 1,562m |

| Sector | Industrials |

| Industry | Security & Protection Services |

| GiC SubIndustry | Electronic Equipment & Instruments |

| TER | 0.00% |

| IPO / Inception | 1990-03-26 |

NSSC Stock Ratings

| Growth 5y | 7.46 |

| Fundamental | 81.1 |

| Dividend | 3.62 |

| Rel. Performance vs Sector | -0.50 |

| Analysts | 4.17/5 |

| Fair Price Momentum | 47.28 USD |

| Fair Price DCF | 29.31 USD |

NSSC Dividends

| Yield 12m | 0.72% |

| Yield on Cost 5y | 2.44% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 100.0% |

NSSC Growth Ratios

| Growth 12m | 29.19% |

| Growth Correlation 12m | 30% |

| Growth Correlation 3m | 7% |

| CAGR 5y | 27.59% |

| CAGR/Mean DD 5y | 1.64 |

| Sharpe Ratio 12m | 0.37 |

| Alpha vs SP500 12m | 0.42 |

| Beta vs SP500 5y weekly | 1.04 |

| ValueRay RSI | 60.52 |

| Volatility GJR Garch 1y | 52.47% |

| Price / SMA 50 | 8.84% |

| Price / SMA 200 | 35.17% |

| Current Volume | 203.9k |

| Average Volume 20d | 475.6k |

External Links for NSSC Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 18, 2024, the stock is trading at USD 44.81 with a total of 203,884 shares traded.

Over the past week, the price has changed by +0.40%, over one month by +15.34%, over three months by +2.14% and over the past year by +30.87%.

According to ValueRays Forecast Model, NSSC NAPCO Security Technologies will be worth about 52.8 in May 2025. The stock is currently trading at 44.81. This means that the stock has a potential upside of +17.79%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 45.8 | 2.28 |

| Analysts Target Price | 28.8 | -35.7 |

| ValueRay Target Price | 52.8 | 17.8 |