Cohen & Steers (CNS) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US19247A1007

Cohen & Steers Inc (NYSE:CNS) is a well-known asset management holding company that caters to institutional investors such as pension funds and endowments. It offers a variety of services through its subsidiaries, including managing equity, fixed income, multi-asset, and commodity portfolios tailored to individual clients. Additionally, the company is involved in launching and overseeing mutual funds, hedge funds, and investments across global markets.

One of the key focuses of Cohen & Steers Inc is on investing in real estate, infrastructure, and natural energy resources. This diversification extends to equity and fixed income investments in sectors like real estate investment trusts. The company also delves into preferred securities as part of its fixed income portfolio through its subsidiaries.

As a leading global investment manager, Cohen & Steers Inc emphasizes real assets and alternative sources of income like real estate, preferred securities, infrastructure, and commodities. Since its establishment in 1986, the firm has been based in New York and has continued to provide comprehensive investment solutions to a wide range of clients. Explore more on their website: https://www.cohenandsteers.com

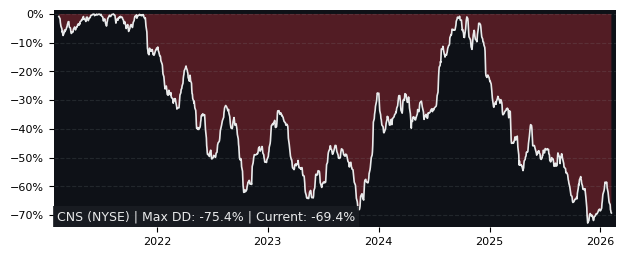

Drawdown (Underwater) Chart

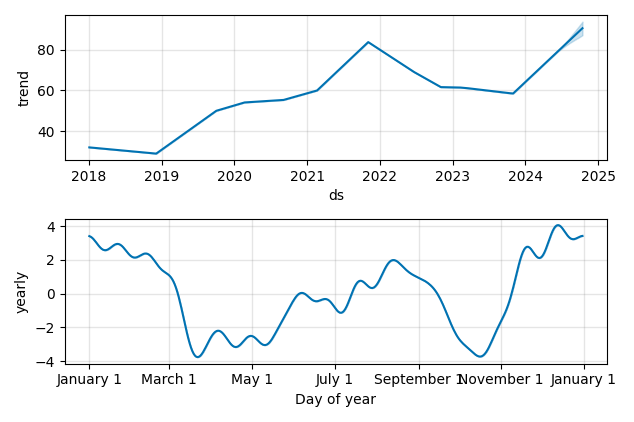

Overall Trend and Yearly Seasonality

CNS Stock Overview

| Market Cap in USD | 3,585m |

| Sector | Financial Services |

| Industry | Asset Management |

| GiC SubIndustry | Asset Management & Custody Banks |

| TER | 0.00% |

| IPO / Inception | 2004-08-13 |

CNS Stock Ratings

| Growth 5y | 3.78 |

| Fundamental | 56.4 |

| Dividend | 4.43 |

| Rel. Performance vs Sector | -0.17 |

| Analysts | 2.67/5 |

| Fair Price Momentum | 65.08 USD |

| Fair Price DCF | 57.92 USD |

CNS Dividends

| Yield 12m | 3.30% |

| Yield on Cost 5y | 5.38% |

| Dividends CAGR 5y | -5.84% |

| Payout Consistency | 89.0% |

CNS Growth Ratios

| Growth 12m | 33.40% |

| Growth Correlation 12m | 50% |

| Growth Correlation 3m | 5% |

| CAGR 5y | 10.23% |

| Sharpe Ratio 12m | 0.84 |

| Alpha vs SP500 12m | -0.92 |

| Beta vs SP500 5y weekly | 1.37 |

| ValueRay RSI | 34.52 |

| Volatility GJR Garch 1y | 39.26% |

| Price / SMA 50 | -3.52% |

| Price / SMA 200 | 6.96% |

| Current Volume | 184.8k |

| Average Volume 20d | 583k |

External Links for CNS Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 03, 2024, the stock is trading at USD 69.66 with a total of 184,815 shares traded.

Over the past week, the price has changed by -0.29%, over one month by -4.60%, over three months by +0.30% and over the past year by +24.94%.

According to ValueRays Forecast Model, CNS Cohen & Steers will be worth about 73.1 in May 2025. The stock is currently trading at 69.66. This means that the stock has a potential upside of +4.92%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 70 | 0.49 |

| Analysts Target Price | 58 | -16.7 |

| ValueRay Target Price | 73.1 | 4.92 |