NVIDIA Corporation: A Journey Through Innovation and Diversification

History

NVIDIA Corporation, a pivotal name in the realm of computing technology, was founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem. Initially, NVIDIA's mission was to develop a distinct silicon solution that would accelerate graphic-intensive applications. This vision birthed the Graphics Processing Unit (GPU), which set the stage for a revolution in computing. Over the years, NVIDIA transitioned from a focus on gaming graphics to becoming a key player across various industries, including automotive, data centers, and artificial intelligence (AI).

Core Business

The bedrock of NVIDIA's success lies in its GPU technology, which caters extensively to the gaming industry, professional visualization, and data centers. These GPUs are not just about rendering high-quality graphics but have evolved to drive advanced AI research, deep learning, and machine learning applications, making NVIDIA a cornerstone in the AI revolution. The company's cutting-edge technology supports a range of computing needs, from the most sophisticated professional applications to everyday computing requirements.

Side Business and Diversification

Besides its core business of GPUs, NVIDIA has strategically diversified its offerings. A significant side business is the development and sale of System on a Chip (SoC) units for the automotive market, enabling smarter, safer driving through AI. Furthermore, NVIDIA's cloud gaming service, GeForce NOW, extends its gaming prowess to the clouds, allowing users to stream high-quality video games on less powerful devices. The company has also ventured into AI data center platforms and networking technology, following its acquisition of Mellanox Technologies, marking its commitment to powering the most intensive computing tasks globally.

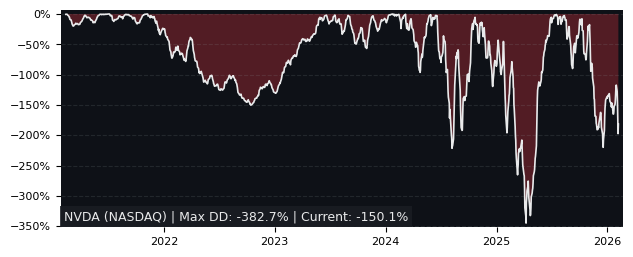

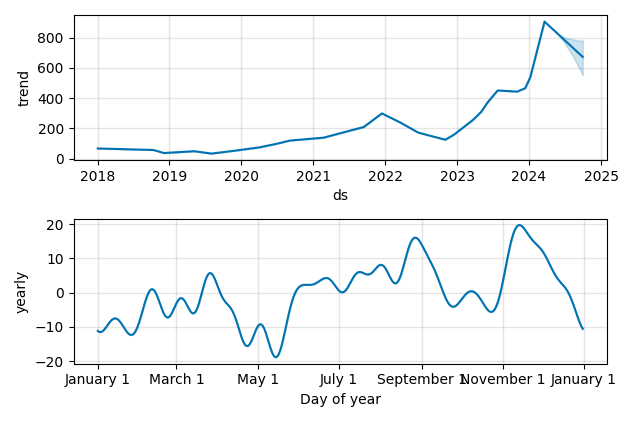

Current Market Status

Today, NVIDIA stands as a giant in the tech industry, with its reach extending beyond its initial gaming niche to pivotal roles in AI, deep learning, and cloud computing. The company has consistently demonstrated its capability to drive innovation and adapt to the evolving technological landscape. As of now, NVIDIA continues to expand its market presence, leveraging its GPU technology and AI expertise to carve out new paths and opportunities in the ever-changing tech environment. Its commitment to innovation and strategic diversification underlines its robust position in the global market, even amidst economic uncertainties and competitive pressures.