Zai Lab (ZLAB) - Stock Price & Dividends

Exchange: USA Stocks • Country: China • Currency: USD • Type: Common Stock • ISIN: US98887Q1040

Zai Lab Ltd (NASDAQ: ZLAB) focuses on developing and bringing to market various therapies for a range of medical conditions like oncology, autoimmune disorders, infectious diseases, and neuroscience in both Mainland China and Hong Kong.

Some of the products in their portfolio include Zejula, a small-molecule poly polymerase 1/2 inhibitor; Optune, a device that aids in delivering tumor treating fields; NUZYRA for bacterial infections like acute bacterial skin and skin structure infections and community-acquired bacterial pneumonia; and Qinlock, used in treating gastrointestinal stromal tumors.

They are also actively working on developing new treatments like Odronextamab, targeting various lymphomas; Repotrectinib, a tyrosine kinase inhibitor focused on specific cancer types; and Margetuximab designed for breast and gastroesophageal cancers.

In addition to the aforementioned, their innovative pipeline also includes potential treatments like Tisotumab vedotin, Adagrasib for various cancers, and Bemarituzumab for gastric and gastroesophageal junction cancer.

Established in 2013 and headquartered in Shanghai, China, Zai Lab Ltd is committed to advancing medical solutions in diverse therapeutic areas. For more information, you can visit their website at https://www.zailaboratory.com.

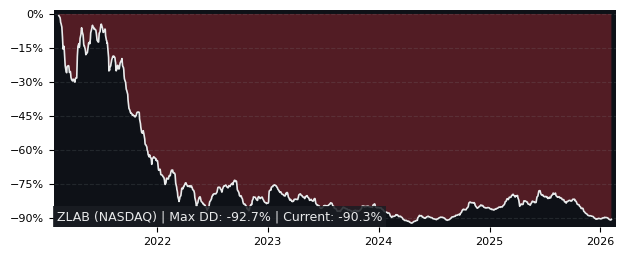

Drawdown (Underwater) Chart

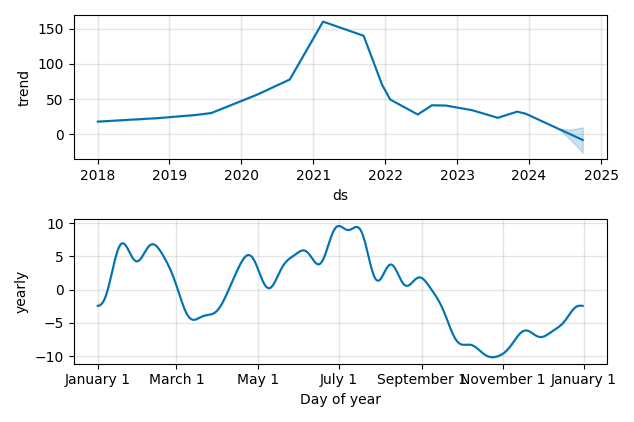

Overall Trend and Yearly Seasonality

ZLAB Stock Overview

| Market Cap in USD | 1,619m |

| Sector | Healthcare |

| Industry | Biotechnology |

| GiC SubIndustry | Biotechnology |

| TER | 0.00% |

| IPO / Inception | 2017-09-20 |

ZLAB Stock Ratings

| Growth 5y | -3.64 |

| Fundamental | -48.8 |

| Dividend | - |

| Rel. Performance vs Sector | -8.53 |

| Analysts | 4.64/5 |

| Fair Price Momentum | 12.83 USD |

| Fair Price DCF | - |

ZLAB Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

ZLAB Growth Ratios

| Growth 12m | -54.52% |

| Growth Correlation 12m | -63% |

| Growth Correlation 3m | -71% |

| CAGR 5y | -10.35% |

| Sharpe Ratio 12m | -0.98 |

| Alpha vs SP500 12m | -83.38 |

| Beta vs SP500 5y weekly | 1.26 |

| ValueRay RSI | 77.53 |

| Volatility GJR Garch 1y | 66.34% |

| Price / SMA 50 | -9.24% |

| Price / SMA 200 | -32.73% |

| Current Volume | 362.6k |

| Average Volume 20d | 489k |

External Links for ZLAB Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of April 27, 2024, the stock is trading at USD 15.91 with a total of 362,617 shares traded.

Over the past week, the price has changed by +13.08%, over one month by -0.25%, over three months by -30.04% and over the past year by -54.11%.

According to ValueRays Forecast Model, ZLAB Zai Lab will be worth about 14.4 in April 2025. The stock is currently trading at 15.91. This means that the stock has a potential downside of -9.49%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 54.1 | 240 |

| Analysts Target Price | 72.2 | 354 |

| ValueRay Target Price | 14.4 | -9.49 |