Cadre Holdings (CDRE) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US12763L1052

Cadre Holdings, Inc. is a company that creates and supplies safety and survivability gear to protect individuals in dangerous situations, both nationally and globally. Their operations are divided into two main segments: Products and Distribution.

Their range of products includes body armor like concealable, corrections, and tactical armor branded Safariland and Protech Tactical. They also offer survival suits, remotely operated vehicles, specialized tools, blast sensors, blast attenuation seats for vehicle safety, bomb suits, duty gear, and various protective equipment for law enforcement such as communications gear, forensic tools, firearms cleaning solutions, and crowd control tools.

Furthermore, Cadre Holdings, Inc. provides third-party products like uniforms, optics, boots, firearms, and ammunition. Their clientele includes first responders like law enforcement, fire and rescue teams, explosive ordnance disposal professionals, emergency medical responders, fishing and wildlife enforcement agencies, and departments of corrections. They also serve federal agencies including the U.S. Department of State, U.S. Department of Defense, U.S. Department of Interior, U.S. Department of Justice, U.S. Department of Homeland Security, U.S. Department of Corrections, and various international government bodies.

Founded in 1964, Cadre Holdings, Inc. has its headquarters in Jacksonville, Florida. For more information, visit their website at https://www.cadre-holdings.com.

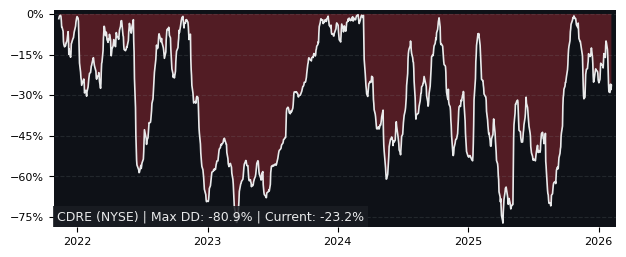

Drawdown (Underwater) Chart

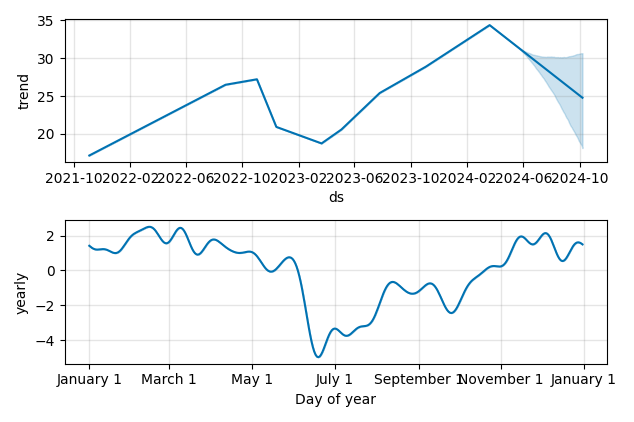

Overall Trend and Yearly Seasonality

CDRE Stock Overview

| Market Cap in USD | 1,336m |

| Sector | Industrials |

| Industry | Aerospace & Defense |

| GiC SubIndustry | Industrial Machinery & Supplies & Components |

| TER | 0.00% |

| IPO / Inception | 2021-11-04 |

CDRE Stock Ratings

| Growth 5y | 7.26 |

| Fundamental | 73.9 |

| Dividend | 4.26 |

| Rel. Performance vs Sector | 2.39 |

| Analysts | 4.29/5 |

| Fair Price Momentum | 35.11 USD |

| Fair Price DCF | 46.73 USD |

CDRE Dividends

| Yield 12m | 0.99% |

| Yield on Cost 5y | 2.21% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 99.3% |

CDRE Growth Ratios

| Growth 12m | 59.26% |

| Growth Correlation 12m | 84% |

| Growth Correlation 3m | -14% |

| CAGR 5y | 38.43% |

| Sharpe Ratio 12m | 1.72 |

| Alpha vs SP500 12m | 36.51 |

| Beta vs SP500 5y weekly | 0.94 |

| ValueRay RSI | 11.71 |

| Volatility GJR Garch 1y | 30.31% |

| Price / SMA 50 | -6.39% |

| Price / SMA 200 | 8.91% |

| Current Volume | 113.5k |

| Average Volume 20d | 277.4k |

External Links for CDRE Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of April 27, 2024, the stock is trading at USD 33.12 with a total of 113,474 shares traded.

Over the past week, the price has changed by +0.79%, over one month by -7.04%, over three months by -2.02% and over the past year by +61.25%.

According to ValueRays Forecast Model, CDRE Cadre Holdings will be worth about 38.9 in April 2025. The stock is currently trading at 33.12. This means that the stock has a potential upside of +17.45%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 42.7 | 28.8 |

| Analysts Target Price | 30.6 | -7.52 |

| ValueRay Target Price | 38.9 | 17.5 |