Nuvation Bio (NUVB) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US67080N1019

Nuvation Bio Inc. is a clinical-stage biopharmaceutical company that specializes in developing innovative therapeutic candidates for oncology treatment.

The company's flagship product, NUV-868, is a cutting-edge oral small molecule BET inhibitor that plays a crucial role in epigenetically regulating proteins responsible for managing tumor growth and differentiation, including prominent oncogenes like c-myc.

Additionally, Nuvation Bio Inc. offers NUV-1156, an AR binder Xtandi tailored to combat advanced-stage prostate cancers, with the potential to transition into earlier treatment lines that are typically addressed through surgical prostatectomy.

Moreover, the company boasts a drug-drug conjugate (DDC) platform that zeroes in on targeting an inhibitor of poly ADP ribose polymerase (PARP) to the anti-cancer warheads of existing drugs, alongside NUV-1176, a PARP inhibitor specifically designed to tackle ER+ breast and ovarian cancer.

Established in 2018, Nuvation Bio Inc. is headquartered in New York, New York, and continues to be a trailblazer in the field of biopharmaceutical innovation. To learn more about the company, visit their website at https://www.nuvationbio.com.

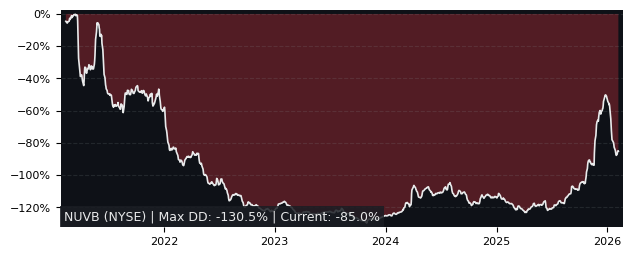

Drawdown (Underwater) Chart

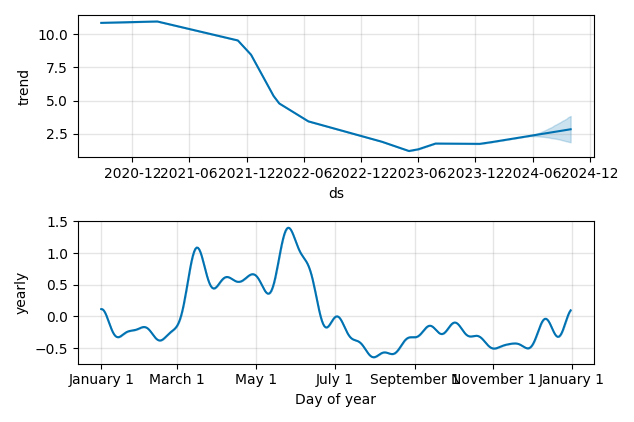

Overall Trend and Yearly Seasonality

NUVB Stock Overview

| Market Cap in USD | 646m |

| Sector | Healthcare |

| Industry | Biotechnology |

| GiC SubIndustry | Biotechnology |

| TER | 0.00% |

| IPO / Inception | 2020-08-24 |

NUVB Stock Ratings

| Growth 5y | -4.41 |

| Fundamental | -74.8 |

| Dividend | - |

| Rel. Performance vs Sector | 4.40 |

| Analysts | 4.67/5 |

| Fair Price Momentum | 2.81 USD |

| Fair Price DCF | - |

NUVB Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

NUVB Growth Ratios

| Growth 12m | 66.46% |

| Growth Correlation 12m | 18% |

| Growth Correlation 3m | 64% |

| CAGR 5y | -30.10% |

| Sharpe Ratio 12m | 0.76 |

| Alpha vs SP500 12m | 39.75 |

| Beta vs SP500 5y weekly | 1.15 |

| ValueRay RSI | 35.00 |

| Volatility GJR Garch 1y | 54.56% |

| Price / SMA 50 | 5.1% |

| Price / SMA 200 | 52.27% |

| Current Volume | 638.8k |

| Average Volume 20d | 1274k |

External Links for NUVB Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of April 27, 2024, the stock is trading at USD 2.68 with a total of 638,754 shares traded.

Over the past week, the price has changed by +3.08%, over one month by -6.94%, over three months by +55.81% and over the past year by +63.41%.

According to ValueRays Forecast Model, NUVB Nuvation Bio will be worth about 3.1 in April 2025. The stock is currently trading at 2.68. This means that the stock has a potential upside of +17.16%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 5.9 | 120 |

| Analysts Target Price | 4.1 | 52.2 |

| ValueRay Target Price | 3.1 | 17.2 |