Simpson Manufacturing Company (SSD) - Stock & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US8290731053

Simpson Manufacturing Company Inc (NYSE:SSD) is a company that designs, engineers, and produces wood and concrete construction products. Their wood construction line includes connectors, truss plates, fastening systems, fasteners, shearwalls, and pre-fabricated lateral systems for light-frame construction. For concrete construction, they offer adhesives, specialty chemicals, mechanical anchors, carbide drill bits, and fiber-reinforced materials, among others. They also provide connectors and lateral products for various construction applications like wood framing, structural steel, and cold-formed steel.

Additionally, Simpson Manufacturing offers engineering and design services, along with software solutions to aid in the specification, selection, and use of their products. Their customer base spans across residential, light industrial, commercial construction, remodeling, and do-it-yourself markets in several countries including the US, Canada, France, Germany, Australia, China, and Vietnam. The company was established in 1956 and is headquartered in Pleasanton, California. For more information, you can visit their website at https://www.simpsonmfg.com.

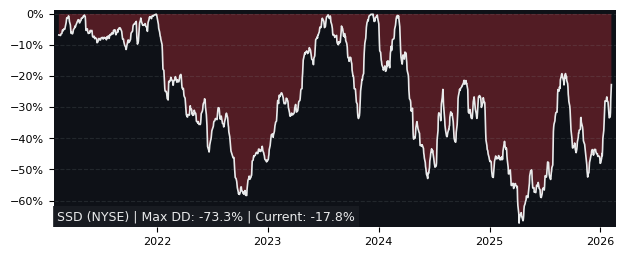

Drawdown (Underwater) Chart

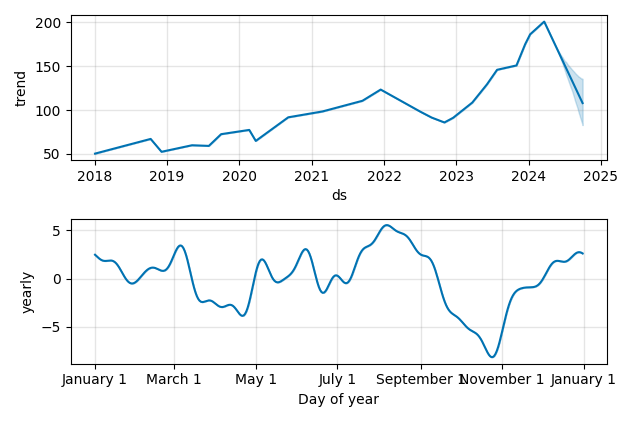

Overall Trend and Yearly Seasonality

SSD Stock Overview

| Market Cap in USD | 7,857m |

| Sector | Basic Materials |

| Industry | Lumber & Wood Production |

| GiC SubIndustry | Building Products |

| TER | 0.00% |

| IPO / Inception | 1994-05-25 |

SSD Stock Ratings

| Growth 5y | 8.39 |

| Fundamental | 89.0 |

| Dividend | 5.97 |

| Rel. Performance vs Sector | 2.23 |

| Analysts | 3.33/5 |

| Fair Price Momentum | 184.30 USD |

| Fair Price DCF | 222.85 USD |

SSD Dividends

| Yield 12m | 0.62% |

| Yield on Cost 5y | 1.79% |

| Dividends CAGR 5y | 3.24% |

| Payout Consistency | 95.5% |

SSD Growth Ratios

| Growth 12m | 38.94% |

| Growth Correlation 12m | 65% |

| Growth Correlation 3m | -12% |

| CAGR 5y | 23.44% |

| Sharpe Ratio 12m | 1.12 |

| Alpha vs SP500 12m | 12.51 |

| Beta vs SP500 5y weekly | 1.13 |

| ValueRay RSI | 8.98 |

| Volatility GJR Garch 1y | 51.77% |

| Price / SMA 50 | -11.12% |

| Price / SMA 200 | 1.97% |

| Current Volume | 549.9k |

| Average Volume 20d | 371.2k |

External Links for SSD Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of April 27, 2024, the stock is trading at USD 173.61 with a total of 549,928 shares traded.

Over the past week, the price has changed by -5.84%, over one month by -13.01%, over three months by -4.66% and over the past year by +45.61%.

According to ValueRays Forecast Model, SSD Simpson Manufacturing Company will be worth about 205.5 in April 2025. The stock is currently trading at 173.61. This means that the stock has a potential upside of +18.36%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 200 | 15.2 |

| Analysts Target Price | 176 | 1.38 |

| ValueRay Target Price | 205.5 | 18.4 |