Cohen and Steers Infrastructure Clo.. (UTF)

Exchange: USA Stocks • Country: USA • Currency: USD • Type: Fund • ISIN: US19248A1097 • Infrastructure

Cohen and Steers Infrastructure Closed Fund (NYSE:UTF) is a popular investment option on the New York Stock Exchange. It focuses on infrastructure assets, offering investors a unique opportunity to gain exposure to this sector. The fund is known for its strong performance and consistent dividends, making it an attractive choice for those seeking reliable income and potential capital appreciation. Its diverse portfolio includes investments in various infrastructure projects such as transportation, energy, and utilities, providing investors with a broad range of assets to diversify their holdings. With a track record of solid returns and experienced management team, Cohen and Steers Infrastructure Closed Fund presents a compelling investment option for those looking to capitalize on the long-term growth potential of the infrastructure sector. Additionally, its listing on the NYSE provides liquidity and transparency for investors, enhancing the overall appeal of the fund. Investing in UTF can be a strategic way to add stability and growth potential to an investment portfolio, particularly for those interested in the infrastructure sector. Its established reputation and focus on income generation make it a valuable addition to consider for long-term investors with a keen eye on the infrastructure industry's future prospects.

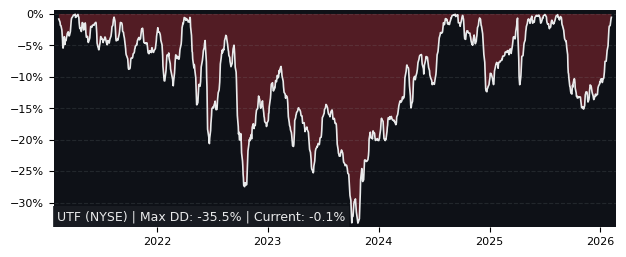

Drawdown (Underwater) Chart

UTF Fund Overview

| Market Cap in USD | 2,670m |

| Style | Infrastructure |

| TER | 2.29% |

| IPO / Inception | 2004-03-30 |

UTF Fund Ratings

| Growth 5y | 3.27 |

| Fundamental | - |

| Dividend | 7.25 |

| Rel. Performance vs Sector | -1.47 |

| Analysts | - |

| Fair Price Momentum | 21.01 USD |

| Fair Price DCF | - |

UTF Dividends

| Yield 12m | 8.04% |

| Yield on Cost 5y | 10.95% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 94.9% |

UTF Growth Ratios

| Growth 12m | 8.49% |

| Growth Correlation 12m | 30% |

| Growth Correlation 3m | 51% |

| CAGR 5y | 6.34% |

| Sharpe Ratio 12m | 0.16 |

| Alpha vs SP500 12m | -20.88 |

| Beta vs SP500 5y weekly | 1.29 |

| ValueRay RSI | 83.11 |

| Volatility GJR Garch 1y | 21.81% |

| Price / SMA 50 | 3.82% |

| Price / SMA 200 | 10.99% |

| Current Volume | 192.1k |

| Average Volume 20d | 221.9k |

External Links for UTF Fund

News

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

What is the price of UTF stocks?

As of April 27, 2024, the stock is trading at USD 23.12 with a total of 192,100 shares traded.

Over the past week, the price has changed by +4.05%, over one month by +2.62%, over three months by +10.43% and over the past year by +9.67%.

As of April 27, 2024, the stock is trading at USD 23.12 with a total of 192,100 shares traded.

Over the past week, the price has changed by +4.05%, over one month by +2.62%, over three months by +10.43% and over the past year by +9.67%.

What is the forecast for UTF stock price target?

According to ValueRays Forecast Model, UTF Cohen and Steers Infrastructure Clo.. will be worth about 23.6 in April 2025. The stock is currently trading at 23.12. This means that the stock has a potential upside of +2.16%.

According to ValueRays Forecast Model, UTF Cohen and Steers Infrastructure Clo.. will be worth about 23.6 in April 2025. The stock is currently trading at 23.12. This means that the stock has a potential upside of +2.16%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 23.6 | 2.16 |