Canadian Natural Resources Ltd: A Comprehensive Overview

History

Canadian Natural Resources Ltd, often abbreviated as CNRL or CNQ, is a powerhouse in the oil and natural gas sector, with its roots tracing back to 1973. Starting as a small operation with limited resources, the company has grown exponentially over the years. Its founders aimed to create a robust, all-Canadian oil and natural gas company that could withstand the ups and downs of the market while capitalizing on the country’s rich natural resources.

Core Business

CNRL’s core business is the exploration, development, production, and marketing of crude oil, natural gas, and natural gas liquids. With operations spread across various regions, including North America, the North Sea, and Offshore Africa, the company has established itself as a leader in the industry. It manages a diverse portfolio of assets that allows it to optimize production and ensure financial stability.

Side Business

Beyond its primary focus, CNRL has also ventured into other areas related to its core operations. This includes electricity generation projects that not only support its operations but also contribute to the local power grids. Additionally, the company is involved in carbon capture and storage initiatives as part of its commitment to sustainability and reducing its environmental footprint.

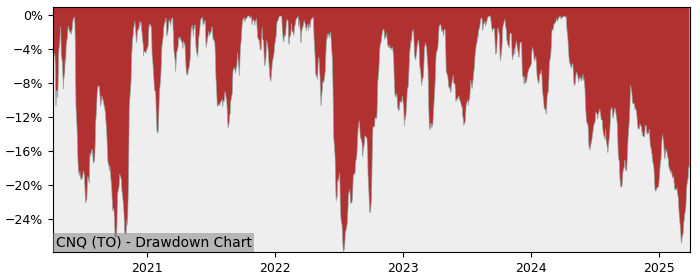

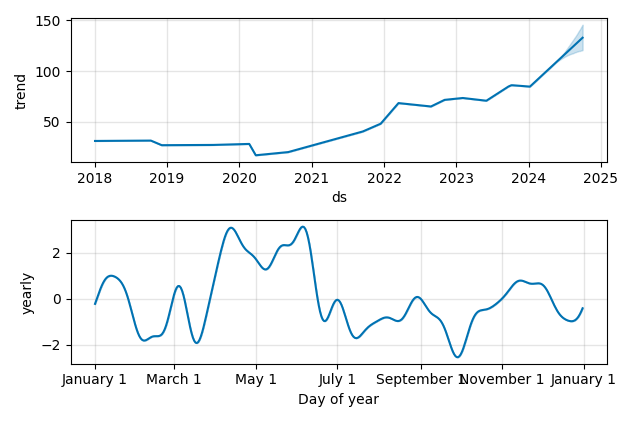

Current Market Status

As of the last update, Canadian Natural Resources Ltd continues to be a dominant player in the oil and natural gas sector. Despite fluctuations in global oil prices and the challenges posed by external factors, CNRL has demonstrated resilience and adaptability. The company has maintained a solid financial performance, with strategic investments aimed at sustainable growth. It has also been focusing on increasing its efficiency and reducing costs without compromising on its commitment to environmental responsibility.